In the last post we have seen budget tips and saving hacks (Blog post:- Financial Future: Easy Saving Hacks & Budget Tips). Now in this post lets dive deeper to answer how to create monthly budget.

Effective money management starts with a solid monthly budget. This financial planning tool doesn’t have to be complicated. This blog post will show you how to budget money effectively, even if you’re a complete beginner. Many people find the idea of budgeting daunting, but it’s a crucial step towards financial freedom. It’s about understanding your income, expenses, and financial goals to make informed decisions about your money.

Step 1: Calculate Your Income and Expenses for an Effective Monthly Budget

Before you create any kind of budget, you need to know where your money is coming from and where it’s going. This is the foundation of any effective monthly budget or spending plan. Start by listing:

- Your Income: Your salary, side hustles, freelance gigs—anything that brings in money. Be sure to use your net income (after taxes) for your calculations.

- Your Fixed Expenses: Rent, utilities, insurance, subscriptions, loan payments—bills you have to pay every month. These are often the same amount each month.

- Your Variable Expenses: Groceries, dining out, shopping, entertainment, transportation—things that change month to month. Tracking these is essential for creating an accurate and realistic budget.

- Your Financial Goals: Emergency fund, debt payments, investments, down payment savings—things that make Future You thank Present You. Include these in your monthly budget.

If you’re not sure where your money’s going, try tracking your spending for a month. Use one of the many budget apps available, a simple spreadsheet, or even just a notebook. You might be surprised at how much you spend on things like impulse purchases and convenience foods. Understanding your spending habits is crucial for creating a budget that works for you.

Step 2: Choose the Best Budgeting Method for Your Needs

There’s no one-size-fits-all budgeting method, but here are a few simple options to help you learn how to budget money effectively:

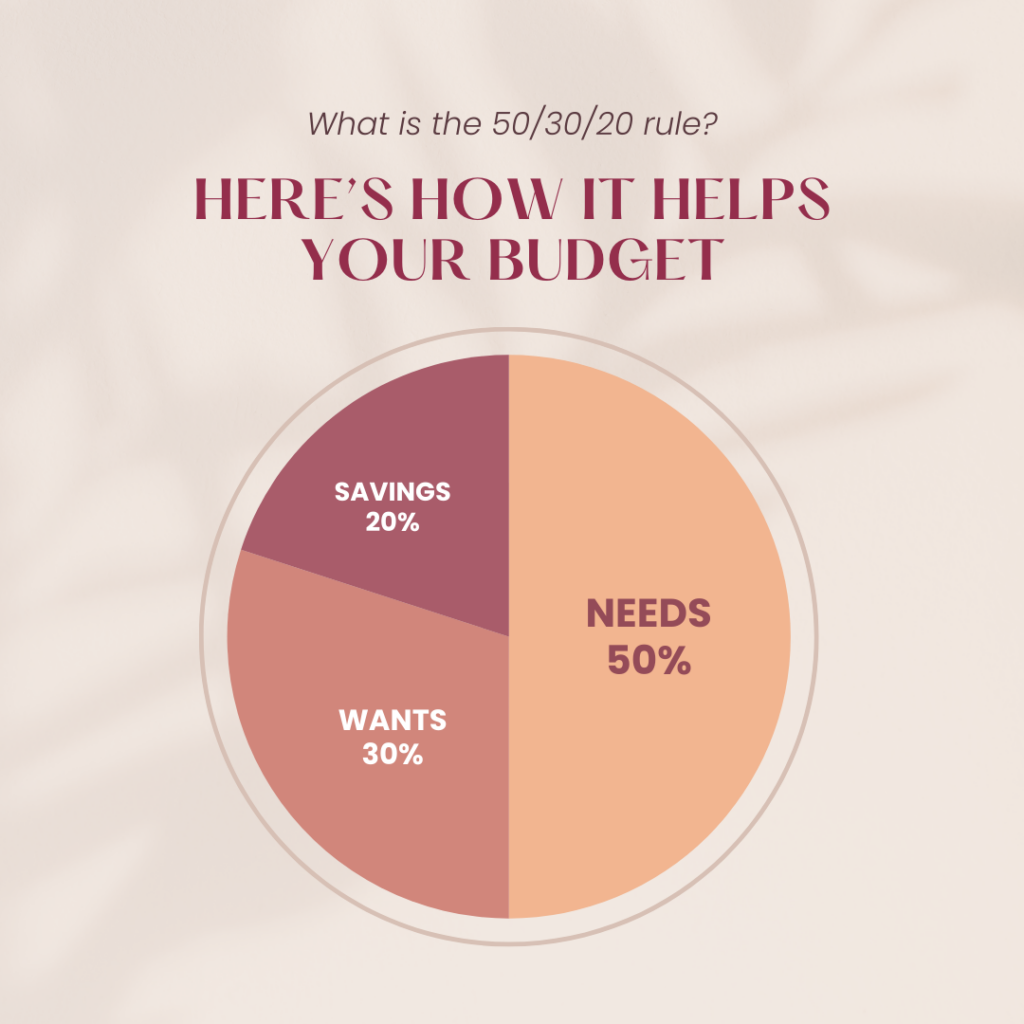

The 50/30/20 Rule (Easy & Flexible Budget Planner)

This popular method divides your income into three categories:

- 50% for Needs (Essential Expenses for Your Monthly Budget): Rent, groceries, bills, insurance, transportation, minimum debt payments.

- 30% for Wants (Lifestyle Spending): Eating out, travel, entertainment, hobbies, non-essential shopping.

- 20% for Savings and Debt (Financial Goals): Emergency fund, investments, extra debt payments, long-term savings goals.

If your expenses are higher in one category, adjust accordingly! The goal is balance, not perfection. This is a great starting point for beginners looking for a simple budget.

The Zero-Based Budget (Every Dollar Has a Job)

With this method, every dollar of your income is assigned a purpose—whether it’s rent, savings, or even a “fun money” category. Your income minus expenses should equal zero. This method is great if you want to be super intentional with your money and are looking for a detailed budget planner.

The Pay-Your-Self-First Budget (Minimal Effort, Big Results)

Before you spend a dime, transfer a set amount into savings or investments. Then, use whatever’s left for expenses. This is a great method if you struggle with saving consistently and want a simple budget approach.

Pick the method that feels right for your lifestyle. The best budget is the one you’ll actually stick to.

Step 3: Automate Your Budget Planner and Make Adjustments

Once you’ve set up your budget planner, make it as effortless as possible.

- Set Up Auto Transfers: Automate savings and bill payments so you don’t have to think about them.

- Use Budgeting Apps: Tools like PocketGuard, YNAB, or even your banking app can help you track spending and manage your monthly budget. Look for the best budget apps for your needs.

- Give Yourself Some Grace: Your budget won’t be perfect every month. Unexpected expenses happen. Adjust, learn, and keep going. Flexibility is key to successful budgeting.

Step 4: Make Budgeting a Habit: Tips for Success

A budget isn’t a one-time thing—it’s a habit. But it doesn’t have to feel like a chore.

- Set a “Money Date” Once a Month: Grab a coffee (or wine), check your progress, and tweak your budget if needed.

- Celebrate Wins: Stuck to your budget? Saved more than expected? Treat yourself within reason!

- Remember Your “Why”: Whether it’s traveling, buying a home, or just not stressing about money, keep your goals in sight.

Free Monthly Budget Template (Excel & Google Sheets)

Ready to get started? Download our free monthly budget template. This easy-to-use template will help you track your income, expenses, and savings goals.

Download links:

Final Thoughts: Take Control of Your Money, One Step at a Time

Budgeting isn’t about restriction—it’s about freedom. A simple budget helps you spend on what truly matters while still living your life.

Start small. Track your spending. Choose a budgeting style. Automate. Adjust. And most importantly—stick with it. Your future self will thank you.

What budgeting tips have worked for you? Share your experiences in the comments below! Download your free monthly budget template now and start your journey to financial freedom!