In a world that often emphasizes instant gratification, the act of saving money might seem outdated. However, saving is not just about putting money aside; it’s about unlocking a future filled with possibilities. [Internal Link: “How to Create a Budget”] It provides a safety net for unexpected expenses, empowers you to pursue your dreams, and offers a sense of financial security.

1.Why Saving Money Matters: Building Financial Security

Saving is a cornerstone of financial health. It provides a buffer for unforeseen events like job loss, medical emergencies, or unexpected repairs. Having an emergency fund can significantly reduce stress during challenging times. Moreover, saving allows you to achieve long-term goals, such as:

- Buying a home: Saving for a down payment is a crucial step in homeownership.

- Funding your education: Whether it’s pursuing higher education or acquiring new skills, saving can make it possible.

- Starting a business: Saving provides the necessary capital to launch and grow a business venture.

- Planning for retirement: Ensuring a comfortable retirement requires diligent saving and investment planning.

2. Start Small, Think Big: Simple Steps to Build Your Savings

Many people feel overwhelmed by the idea of saving, believing they need to save large sums to make a difference. However, consistent small savings can have a significant impact over time. Here are some simple steps to get started:

How to Create a Budget That Works for You:

- Track your income and expenses to understand your spending habits.

- Identify areas where you can cut back, such as dining out, entertainment, or subscriptions.

- The 50/30/20 rule (50% needs, 30% wants, 20% savings) can be a helpful framework.

How to Automate Your Savings:

- Set up automatic transfers to your savings account each month.

- This “pay yourself first” approach ensures consistent savings without relying on willpower.

How to Find Small Ways to Save:

- Bring your lunch to work instead of eating out.

- Shop for groceries strategically, using coupons and comparing prices.

- Explore free or low-cost entertainment options.

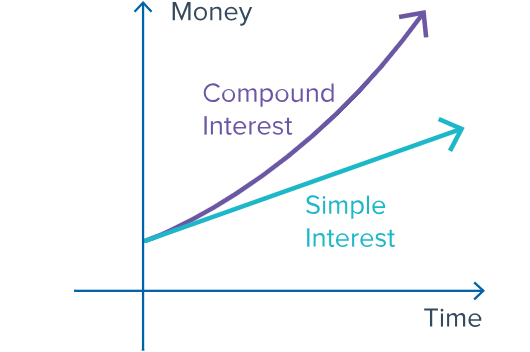

3. The Power of Compound Interest: Let Your Money Grow

Compound interest is the interest earned on both your initial savings and the accumulated interest. It’s the magic of making your money work for you. The earlier you start saving and investing, the greater the impact of compound interest.

- Example: Imagine you invest $100 per month for 20 years in an account with an average annual return of 7%. Using a compound interest calculator, you’ll find that your investment can grow to over $64,000.

- To determine how much your money can grow using the power of compound interest follow this online calculator.

Long-Term Savings Strategies: Investing for Your Future

To maximize your savings potential, consider these long-term strategies:

How to Diversify Your Savings Portfolio:

- Explore different savings avenues, such as high-yield savings accounts, certificates of deposit (CDs), and investment options like mutual funds and ETFs.

- Diversification helps to reduce risk and potentially increase returns. [External Link: By Harvard Business School ]

How to Set Specific Financial Goals:

- Whether it’s saving for a down payment, funding your child’s education, or planning for retirement, having clear goals keeps you motivated.

Simple ways to Stay Disciplined:

- Avoid dipping into your savings for non-essential expenses.

- Stay committed to your savings plan, even during challenging times.

Educate Yourself:

- Continuously learn about personal finance by reading books, following financial blogs, or consulting with a financial advisor. [External Link: Financial literacy by European Commission].

4. Conclusion

Saving money is a journey, not a destination. By starting small, thinking big, and implementing consistent saving habits, you can build a strong financial foundation and unlock a future filled with possibilities. Start saving today and watch your financial dreams take flight!

Start saving today! Open a high-yield savings account and watch your money grow.

One comment on “Financial Future: Easy Saving Hacks & Budget Tips”